This appendix contains the following topic:

Introduction to Handling Periodic Inventory

The following method of handling inventory is based on the Periodic Method. The Inventory Control module is based on the Perpetual Method; so if you are using that method, disregard this appendix.

For inventory and cost of goods sold to appear correctly on a Profit and Loss Statement, you must follow certain procedures before you print the statement. If these steps are followed, the cost of goods sold section will appear as follows:

|

Current Period |

Year-To-Date |

||

|

Beginning Inventory |

9,999.99 |

99,999.99 |

|

|

Purchases |

999.99 |

9,999.99 |

|

|

Ending Inventory |

(9,999.99) |

(99,999.99) |

|

|

|

________ |

_________ |

|

|

Cost of Goods Sold |

999.99 |

9,999.99 |

|

Purchases are added to beginning inventory. Then ending inventory is subtracted to yield cost of goods sold.

Additional accounts for purchase returns and allowances, purchase discounts, etc., may be included. What is represented above is the basic structure of the cost of goods sold section.

In manual bookkeeping, the above entries for beginning and ending inventory appear as adjustments to the trial balance. Beginning inventory is brought onto the P&L statement by posting a debit to Beginning Inventory and a corresponding credit to the balance sheet Inventory account. Ending inventory is noted by posting a credit to Ending Inventory and a corresponding debit to the balance sheet Inventory account.

In General Ledger, the first step in entering and posting these adjustments is to define a G/L account which will be used for net changes to inventory. Let us call this account Net Change to Inventory.

The second step in entering and posting these adjustments is to make an entry which debits <Net Changes to Inventory> for an amount equal to the opening balance of inventory for the period. The corresponding credit is to Merchandise Inventory. For example,

|

DR |

Net Change to Inventory |

96,833.45 |

|

|

CR |

Merchandise Inventory |

96,833.45 |

|

The third step in entering and posting these adjustments is to make an entry which credits Net Change to Inventory for an amount equal to the ending balance of inventory for the period. The corresponding debit is to Merchandise Inventory. For example:

|

DR |

Merchandise Inventory |

101,520.61 |

|

|

CR |

Net Change to Inventory |

101,520.61 |

|

The net result of these debits and credits is that the beginning balance of Merchandise Inventory (within G/L) is the opening inventory balance, the ending balance of Merchandise Inventory is the balance of inventory as of the end of the period, and the net change (period to date) of Net Change to Inventory is the net change to inventory.

The Net Change to Inventory account will have a credit balance for the period if there is more inventory on hand at the end of the period than at the beginning of the period, and represents the amount by which inventory increased during the period.

The Net Change to Inventory account will have a debit balance for the period if there is less inventory on hand at the end of the period than at the beginning of the period, and represents the amount by which inventory decreased during the period.

The above entries should be dated within the period for which you are printing financial statements.

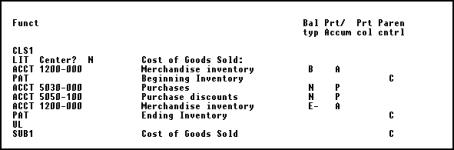

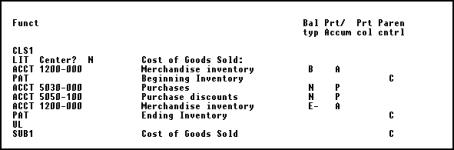

On your P&L layout, enter account codes similar to the following:

The functions of the above lines are to:

| • | Clear subtotal one. |

| • | Accumulate the beginning balance of inventory using the Merchandise Inventory account. The amount accumulated will be the opening balance of the Merchandise Inventory account for the period being printed. |

| • | Print this accumulated beginning balance (using the PAT code to name the balance Beginning Inventory). |

| • | Print the net changes in purchases and the net changes in purchase discounts. |

| • | Accumulate the ending balance of inventory using the Merchandise Inventory account. Accumulate this using the ending balance of this account reversed. The amount accumulated will be the ending balance of the Merchandise Inventory account for the period being printed reversed. In the normal case, this will result in a credit balance being accumulated. |

| • | Print this accumulated ending balance (using the PAT code to name this balance Ending Inventory). |

| • | Print the subtotal SUB1, naming it COST OF GOODS SOLD. |

Continuing with the example above, if purchases were $10,000 for the period and purchase discounts were $1,000 for the period, the debits and credits above would result in the following printout using this layout:

|

Beginning Inventory |

96,833.45 |

|

Purchases |

10,000.00 |

|

Purchase discounts |

(1,000.00) |

|

Ending Inventory |

(101,520.61) |

|

|

__________ |

|

COST OF GOODS SOLD: |

4,312.84 |

Note that the account, Net Change to Inventory, does not appear on the P&L Statement. The beginning and ending balances of the inventory account are used directly. The ending balance, which would normally be a debit, is reversed (multiplied by minus one) thereby showing a credit. Since the parentheses control at the PAT code is C, the printed amount is enclosed by parentheses.

This procedure meshes with automatic year end closing, since the net changes to inventory have been posted to a P&L account. The year ending procedure picks up this net change and includes it in net income entries that are posted as part of the Close a year selection.